Friday, December 28, 2007

Strong Banks are Very Cheap

Wednesday, December 19, 2007

A Discussion about the Economy with an Old Friend

GCD: I think they are less that 50/50, and I believe the consensus of our investment committe is that growth will slow, but recession is not the best bet. I have one chart I'd like to show you that I believe is not well understood and most people forget to take into consideration when they project recession.

GCD: I think they are less that 50/50, and I believe the consensus of our investment committe is that growth will slow, but recession is not the best bet. I have one chart I'd like to show you that I believe is not well understood and most people forget to take into consideration when they project recession.The chart at the right is of US Net Exports of Goods and Services since 1970. The chart clearly shows that exports have not only been falling relative to imports since 1980, but that their rate of descent has accelerated dramatically since the early 1990s. That trend has been firmly in place until just in recent months when exports have turned higher relative to imports. Indeed, in the most recent quarter, exports represented nearly 20% of total real GDP.

Friend: So you are saying that exports alone may keep us out of recession?

GCD: No, I personally think the economy overall will be stronger than most people think. The housing issue is a tough hurdle to overcome, but I just don't believe that housing in most parts of the country got as overheated as in did in California and Florida, for instance; consequently, I don't think the unwinding of the excess housing stock in the country will linger as long as most people seem to believe. Export growth will almost certainly continue, so any good news in housing will produce more overall growth than Wall Street now predicts.

Friend: Exports are rising because of the fall in the dollar, correct?

GCD: I have said many times that oftentimes the seeds of destruction and the seeds of regeneration are in the same pod. The US's consumer mentality and heavy use of imported petroleum have caused a trade imbalance with almost every country in the world. In essence, we were trading dollars for goods. As those dollars were translated back into the home country's currency, dollars are sold and the home currency bought, ie., a weak dollar.

Friend: But for net exports to have turned higher, the dollar must have fallen sufficiently that our goods and services are now very competitive in the global economy? That still seems hard to believe. Most people think the dollar is destined to fall a far as the eye can see.

GCD: My best explanation for the power of a weaker dollar is the following: In the case of a citizen in Windsor Canada, a year ago a Cadillac at the local dealer and the one across the river in Detroit cost about the same. As a result of the collapse of the US dollar vs the Canadian dollar, the same Cadillac in Detroit is now nearly 20% cheaper than the one in Windsor. Thus, it pays the Canadian to drive across the bridge and "buy American."

Friend: I just saw where the big European consortium, Airbus -- Boeing's biggest competitor -- is saying that as a result of the collapse in the dollar, they will move $2 billion dollars of research on their new planes to a dollar denominated country. That would seem to mean that some, if not all of that work may come to the US.

GCD: I know we are speaking anecdotally, but this is happening all over the world. The fall in the dollar has made us more competitive and companies the world over have to deal with it.

Friend: Then I guess we are saying that the great bugaboo of a falling dollar is not all bad.

GCD: Yes, it eventually brings itself into an equilibrium level and begins to stabilize. That appears to be happening now, and I don't see it turning around anytime soon. I believe those people who are calling for a recession are missing the contribution of imports to the US economy .

Friend: That is what I have been thinking, as well.

Next time: Are US stocks overvalued?

Monday, December 10, 2007

McD's May Be Going Up, Because It's Going Up

Momentum is a wonderful thing, when momentum is in your favor. Only problem is momentum is like the wind -- nobody knows where or for how long it blows.

Momentum is a wonderful thing, when momentum is in your favor. Only problem is momentum is like the wind -- nobody knows where or for how long it blows.As the subprime crisis has extracted its toll from the banks and retail stocks, that toll has been invested in the so-called defensive stocks: consumer staples, oils, and utilities.

The chart at the right is our 20-year Dividend Valuation chart of McDonald's. If you wondered where the money went that they took out of your favorite bank stock recently, look no farther because a bunch of it went here. McDs has been moving straight up in 2007. Much of its rise has been warranted because the company has had a string of good earnings reports and a big dividend hike. However, some of the recent run up is probably due to momentum -- meaning its going up because its going up.

Our model is suggesting that the stock has a projected rate of return for the next twelve months of only 5%, give or take 5% (represented by the blue striped bar at right). In our way of thinking that means, judging from the last 20 years, the most probable year-ahead rate of return for MCD is between 0% and 10%. That does not give us much of a margin of safety if the US economy is a little stronger than many observers now believe. A stronger economy could well cause the momentum of MCD to reverse.

The Fed is meeting today, and to the extent that they keep cutting rates, the odds improve that economic growth may surprise on the upside in the year ahead. If that is the case, financials would be a better buy than staples. Almost all the financials we follow are nearly 25%-35% undervalued, again based on their long-term relationships to dividend growth.

A word of caution. We are only buying highly rated financials whose dividend is secure. I have no idea where Countrywide Financial or Washington Mutual will be a year from now. Additionally, while many consumer staples stocks are overvalued, many are not. I'll have more to say on some of the undervalued staples in future blogs. We will also have more to say on what financials we like.

Thursday, December 06, 2007

Could Oil Prices be Topping?

Oil prices recently flirted with $100 per bl and the consensus of most analysts is that it is only a matter of time before that level is taken out, and we move ahead to ever higher prices. The argument is that with the developing economies of China, India, and Russia growing rapidly and representing nearly half of the world's population, it is inevitable that the price of oil can only rise as far as the eye can see.

Oil prices recently flirted with $100 per bl and the consensus of most analysts is that it is only a matter of time before that level is taken out, and we move ahead to ever higher prices. The argument is that with the developing economies of China, India, and Russia growing rapidly and representing nearly half of the world's population, it is inevitable that the price of oil can only rise as far as the eye can see.When I hear the term "as far as the eye can see," I recall how often it turns out that the eye can't see very far. Indeed, it is almost a certainty that the equilibrium price for oil is far less that the current selling price. Anytime the as-far-as-the-eye-can-see crowd is at work, you can bet that they have laid up lots of bets on oil and, thus, there is a speculative premium in the current price.

I said in a September 2006 blog that what always kills real estate is the gap between market prices and rents. When rents begin to lag way behind prices, it means that the supply of housing is greater than the demand, and the cost of carry will soon become a factor for speculators in the decision to hold or sell the property, even if prices appear to be moving higher.

As it relates to oil, I believe that the best measure of "true demand" is the price of gasoline at the pump. Gasoline prices are thought by many to be inelastic. After all, we have our lives to live and; well, we have to drive to live, etc., regardless of price.

I have been thinking for the last couple of years that to assume that gasoline prices are inelastic is probably not justified. The fact that demand for gasoline has not fluctuated much with higher prices in the past may be because total fuel costs for the average household budget has been a relatively small percent, in the range of 4%-5%.

The chart above is a scattergram (you may want to click to enlarge) that shows, as you would suppose, there is a very high correlation between crude oil and gasoline prices -- R2 of .94. Note the three arrows I have drawn on the chart at the far right. These points, which are the last three months, suggest that prices at the pump are much lower than we would expect them to be based on their historical relationship to crude oil. For instance, last week when oil surged to near $100 per bl, gasoline prices at the pump (Midwest) should have been near $3.50 a gallon. Oil prices in my region never got above $3.15. Currently with crude prices near $90 per bl, the chart indicates that prices at the pump should be near $3.20. Bloomberg shows that the prevailing price in the Midwest in currently $2.95 a gallon.

The lag in prices can be the result of only three reasons. 1. Oil refiners and marketers are holding down the price of gasoline, 2. Consumers are balking at paying much above $3.00 a gallon, or 3. A combination of both.

If consumers are balking at higher gasoline prices, crude oil prices would at the least flatten out, if not fall. The reason oil prices may fall more than you might expect is because of the rampant speculation in crude oil futures.

I'll keep you posted on this trend in future blogs. Could it be that some elasticity of demand is appearing? We'll soon see.

Wednesday, November 28, 2007

Beware of Momentum Shifts

Wednesday, November 21, 2007

Thanksgiving Blessings

Saturday, November 17, 2007

Berkshire Hathaway: Is It Overvalued?

Thursday, November 15, 2007

Just How Big and How Bad is the Subprime Mortgage Problem?

- Subprime is about 13% of the $10 trillion total mortgage market, or about $1.3 trillion.

- Currently about 17% of subprime loans are delinquent. For our purposes here, however, let's assume that 50% of subprime loans ultimately default.

- That would put the total defaults at $650 billion.

- But remember these loans are backed by homes, so let's assume that when the homes are ultimately sold, the debt holders will receive 50 cents on the dollar, or $325 billion.

- My study of the situation indicates that the banks and investment banks sold about 50% of the loans to insurance companies, retirement plans, hedge funds, private equity groups, etc., and kept the rest. That would put the amount in banks and investment banks at near $163 billion.

- Next, assumed that approximately 70% of the loans stayed in the US and 30% went abroad. That would give us a final exposure to the US banking system of near $115 billion.

Tuesday, November 06, 2007

Bank of America: Dividend Growth Will Continue and the Price Looks Right

Many readers have asked that I show the Dividend Valuation Model for Bank of America. The company recently announced disappointing earnings and has seen it price fall off with the other big banks.

Many readers have asked that I show the Dividend Valuation Model for Bank of America. The company recently announced disappointing earnings and has seen it price fall off with the other big banks.Having said this, I believe the bank is dealing with its issues in investment banking and will be one of the first big banks to get its writedowns behind it.

The current dividend yield is 5.5%. BAC has raised it dividend in each of the last 20 years. Dividend growth, during that time, has averaged nearly 13%, and nearly 15% over the last 5 years.

The past is no guarantee of the future, but I believe the company will continue to increase dividends, albeit at a slower pace.

Wall Street analysts are now estimating that BAC's earning over the next 3-5 years will average near 8%. The chart above uses 8% dividend growth in 2008.

The green candy cane at the far right of the chart is the implied value of BAC at this 8% dividend growth rate. That price is $56 per share.

No one knows the magnitude of the subprime loan problems that lurk in bowels of banks today, but we can make some simple observations. Unless the US economy falls off a cliff, the banks have enough capital to withstand a lot more trouble that the subprime problems appear to present. BAC's management has a reputation for being straight talkers. They did not sugar coat their writeoffs, and CEO Lewis said the performance was unacceptable and that changes were coming in the investment banking group.

By the swiftness of the subsequent actions, the plans must have already been underway on the day of the earnings announcement, because three weeks later they have already replaced many of the top managers of investment banking, and announced the elimination of 3,000 jobs.

Including dividends, if BAC reaches $56 per share over the next 12 months, that will represent nearly a 29% total return.

I admit that it doesn't seem possible in light of the news of the day, but, as I said earlier, if Fed does its job and the economy has even modest growth, the subprime fiasco will gradually fade from the headlines, which will allow the banks to move higher.

I own BAC and have for many years. At 5.5% dividend yield, it doesn't take much price appreciation to make a double digit return. That might look pretty good a year from now.

If you are not a client of DCM, please do not act on my discussion here alone. Consult your own financial advisor.

Thursday, November 01, 2007

The Fed Got it Wrong!

- The odds are increasing for a recession.

- The Fed got it wrong.

I do not believe there is a high probability of a recession, but I do believe that the Fed got it wrong. The good thing is, they can still get it right and well before the next meeting in December. Fed governors give speeches everyday. All they have to do is to take away the implication that the rates cuts are done.

They have now lost the lead in taming the ongoing banking worries, and they will have to do some heavy lifting to regain that position, but if they speak with one voice, they can regain their rightful leadership position by December.

As it now stands, the Fed Funds Target Rate is 4.5%. After yesterday's and today's rallies in T-Bills, they now yield about 3.7%, yield spread of about .8%. That is still high by historical standards and implies the credit and liquidity crunch is far from over.

The Fed is the banker of last resort, and I'm confident that they will ultimately get it right. Having said this, I think they made a mistake in reading the markets that Alan Greenspan would not have made.

Tuesday, October 30, 2007

Fed Rate Cut: 50 Basis Points or 25?

Monday, October 29, 2007

The Flip Side of Maximum Pessimissm

Tuesday, October 23, 2007

Templeton's Theory of Maximum Pessimism

Wednesday, October 17, 2007

Investing versus Speculating -- UTX

Monday, October 15, 2007

Using Dividends to Predict Stock Prices

- Predictable: first we look for companies where some combination of fundamental data reaches an acceptable threshold of correlation to changes in their stock prices.

- Undervalued: second we look for companies where the predictability equation suggests a stock is undervalued, based on a simple one year projection of fundamental changes.

- Momentum: third we look for companies that pass the first two screens and have some validation of their undervaluation manifested in the upward movement of their stock prices.

Thursday, October 11, 2007

It's a Subprime Crisis, Not a Banking Crisis.

After Countrywide Financial warned in July that they were experiencing delinquencies across all credit quality classes of mortgages, the stock market went into a tailspin, assuming that all banks were either deep into subprimes or that prime mortgages were beginning to default.

After Countrywide Financial warned in July that they were experiencing delinquencies across all credit quality classes of mortgages, the stock market went into a tailspin, assuming that all banks were either deep into subprimes or that prime mortgages were beginning to default.We were watching the chart at the right, which shows the % of delinquencies of subprime (blue line) and prime (orange line). It has been clear that subprimes have been in big trouble for the last two years, with delinquencies now running at over 15% of subprime loans oustanding. So if the big banks are deep into subprimes, they will, indeed, be taking big write offs. However, if they have managed to sell off or avoid their low quality loans, the prime sector of mortgaes would appear to be in very good shape, with only 2.7% of prime loans currently delinquent.

Our analysis of Bank of America, Wells Fargo, and Wachovia, tells us that these three major US banks have only modest amounts of subprime loans and that they are well secured and manageable.

Wachovia said in their July earnings meeting that they did not have any subprime loans. Since then they have announced that they are going to commit $15 million to the lower quality market. We think this is a smart move, since almost everybody else is exiting the sector. There are probably some great bargains.

The evidence is growing steadily that the big banks in the country sold off their high risk mortgages to the big pools of money that Wall Street was throwing their way.

The market is on pins and needles awaiting the big banks to announce their earnings, or lack of them. We are firmly in the camp that believes the news will be better than Wall Street now believes, and for this reason, we believe the aforementioned banks represent very good values.

Saturday, October 06, 2007

From Sea to Shining Sea

Wednesday, October 03, 2007

New Estimate of the "Fair Value" of the Dow Jones Industrials

As a reminder,

in our January 2007 Barnyard Forecast with the DJ 30 near 12400, we said that our Dividend Valuation Model was signally that the "fair value" for the Dow in the year ahead was near 14,000. Indeed, that is about where the market stands today.

in our January 2007 Barnyard Forecast with the DJ 30 near 12400, we said that our Dividend Valuation Model was signally that the "fair value" for the Dow in the year ahead was near 14,000. Indeed, that is about where the market stands today.We have updated the model from time to time over the last 9 months to reflect actual dividend growth and changes in interest rates, and except for a brief period in early summer when rising interest rates drove it lower, the model has stayed near 14,000.

In our judgment, the solid performance of the Dow has been spurred by the near 12% dividend growth for 30 companies in the Average .

The chart above shows our estimate for the "fair value" of the DJ 30 in the year ahead, again using our estimates of dividend growth and interest rates. The predicted level turns out to be near 15,500. That would be a price increase of near 10%. Adding in dividends, our best guess for the total return of the Dow Jones over the next 12 months would be near 12%.

That may seem a bit optimistic in the face of all of the uncertainties in the markets and the economy, but we would not be surprised to see a return of that magnitude. We believe the US economy will be stronger than most people are predicting, and US multi-national firms will continue to benefit from the expanding global economy.

In addition, you will notice that the model has done a good job of identifying the "fair value" of the DJIA. It did not go along with the "tech head fake" of the late 1990s and correctly signaled how undervalued the Dow became in 2003, 2004, and 2005. Until it proves otherwise, we don't think it would be wise to ignore the voice of the model.

We'll keep you posted on how this estimate turns out as the year progresses.

Friday, September 28, 2007

Target is on Target

ahead.

Real estate news is gripping the headlines, but it is interesting to note that only 2.7% of "prime" mortgage loans are in default and that is where 90% of all mortgage loans are located. The subprime mess is a small part of the mortgage pie, and even though it is causing lots of pain, it does not drive the economy of the United States. Jobs drive the US economy and America is at work and that is the reason that delinquencies on prime mortgages are so low.

Indeed, as it relates to the retailers, we have also found that "he who hollers first" is often the ultimate winner. In this regard, Target is a company we like a lot. They have the right strategy, the right product mix, and we believe they will have a solid Holiday selling season and continue to gain on Walmart.

Our Dividend Valuation Model above shows that TGT is as good a value as it has been since 1996.

Target may not seem like an obvious pick for these times, but who doesn't know that? The "Christmas isn't coming" crowd got out of retail a long time ago. When they see that they are wrong, they will be back pushing Target and the other top flight retailers higher.

Monday, September 24, 2007

Oh Canada !

Whether or not the central banks of many of the world's developed nations acknowledge it or not, they will soon begin cutting interest rates. The reasons are plentiful but two stand out: the US economy will soon begin to trend lower and with it most of the rest of the G-7 nations.

Whether or not the central banks of many of the world's developed nations acknowledge it or not, they will soon begin cutting interest rates. The reasons are plentiful but two stand out: the US economy will soon begin to trend lower and with it most of the rest of the G-7 nations.Europe has already slowed, Japan is having one of its never-ending political upheavals, and China and India are attempting to slow their economies in the face of rising inflation.

Additionally, the recent cut in rates by the US Federal Reserve has spiked the US dollar lower against most of the other world currencies. This will give US companies a powerful competitive advantage in the global markets, and at the same time, make foreign exports to our nation more costly. Taken together, these forces will cause a string of interest rate cuts around the world, probably beginning with Canada.

In the picture I see forming, our Canadian neighbors may well come out looking very good for a period of time. They are a natural resource exporting nation, so their products will continue to be in demand, even if prices begin to stabilize.

Canada's banks are strong, with few of the subprime issues that will continue to nip at the heals of American banks, and finally, the country's Conservative government is finally beginning to deliver on some campaign promises. Importantly, as I said last time, Canada just cut corporate income taxes to near 30%, among the lowest in the developed world, and well under US corporate tax rates.

In running Canadian companies through our Dividend Valuation Model, I see many that are cheap. In the coming months, I will describe a few here.

The best valuation I see is Toronto Dominion Bank (see chart above). It is the second largest bank in Canada and has been making strategic acquisitions in the US. Its combination of a 2.8% dividend yield and low double-digit dividend increases over the past few years has made it a solid performer but has still left it significantly undervalued.

Our model says (I am showing TD in its local currency) that the stock may be as much as 15% undervalued, based on my estimate of next year's dividend growth.

Canada's natural resource oriented economy will insulate it from the economic slowdown that may hit most of the rest of the G-7 nations. Indeed, Canada and the US may be the only G-7 nations that will not experience any negative quarters of economic growth over the next six months to a year.

Sunday, September 23, 2007

Soaking the Rich Will Backfire on the Politicians

Tuesday, September 18, 2007

Stocks Twelve Months After a Rate Cut

If history is a guide, the Fed will cut rates today and will continue to cut for at least the next four months.

The top part of the chart at the right shows the graphs of the Fed Funds Target Rate and the yields on 90-day T-bills. The bottom of the chart shows the difference between the two in red. I discussed the significance of the recent divergence between the two short-term rates in our Sept. 4th post.

There have been four previous divergences that have approached one percent over the past 20 years: the crash of 1987, the S&L troubles of 1989, the Asian Financial crisis in 1998, and the popping of the tech bubble in 2000. In each case, as the divergence between Fed Funds and T-bills approached one percent (.9% more precisely) the Fed cut rates and the differential and, ultimately, the crisis went way.

I have done some additional studying of these divergences and I see two additional areas of interest:

- On average, after rates were cut, Fed Funds were lower by .75%, within four months . Thus, if history is to be our guide, today's cut is just the beginning.

- Twelve months after the first Fed rate cut during three of the credit crunches (1987,1989,1998), stocks were higher, including dividends, by nearly 20%. In the year following the tech bubble, stocks were down nearly 15%, including dividends. The average for the four periods was about 12%.

After what we have waded through 2007, the hopes of a 12% total return over the next year sounds very acceptable. However, I think it may well be better than that because of the unusual circumstances surrounding the poor performance of stocks in the year after the popping of the tech bubble. That pushed us into the time of Enron and then the 9-11. It would have been hard to imagine that stocks could have risen during that time, no matter what the Fed was doing.

Thus, I think it is best to call the period after the tech bubble a special case and drop it from our analysis. If we do that, as I said earlier, the average total return after the Fed started cutting rates in the other three occurrences of a credit crisis, was near 20%.

As they say, the future is not the past, but sometimes it is the best guide we have.

Wednesday, September 12, 2007

The Dawn of Bernankespeak or Not Speak

- 4.75%. . . . . . .74%

- 5.00%. . . . . . .26%

If you do the math, 100% of investors in Fed Funds believe at least a .25% rate cut is coming. Significantly, and perhaps surprisingly 74% of investors believe a .50% cut is at hand. I'm in this latter camp for reasons I have discussed earlier.

Here's where everyone is flying a bit blind. If Greenspan would have seen this Fed Fund action and he had no intentions of cutting rates by half a percent, he would have Greenspeaked it --talked it down.

We don't know if that is how Bernanke is going to operate. He may believe in more openness but less guidance and less Bernankespeak. If this is the case, my thinking is a quarter percent cut will be viewed as a disappointment by the stock market and it may well sell off. Heaven forbid if rates aren't cut at all.

The saving grace is the Fed's statement accompanying their decision. They can still signal there intentions in the statement which would have the effects of muting the actual move they might make. That may be where Mr. Bernanke has decided to speak.

I can't remember a Fed meeting in years where so many investors are so confused about the outcome. Should make for an interesting day.

Thursday, September 06, 2007

We are Bullish on Stocks

Each week our investment policy committee deals with the events and issues of the day, as well, as charting the course of our investments.

We saw the troubles in real estate coming. We were convinced they would be worse than what most people thought. We said as much here 15 months ago.

We are surprised that the subprime mortgage mess is as widespread as it is. Unknowns in the banking system are always unnerving, and we believe the damage is enough to warrant the Fed starting to cut the Fed Funds rate.

In the short-run, say the next six weeks, the market could be very volatile. But, if the Fed moves in a measured way, the economy and the corporations that produce most of our goods and services will perk up in the coming months and provide a very healthy stock market. Here's why:

The credit crunch and the housing market could well get worse before they get better. It does appear, however, to be fairly contained. But, at this point, the Fed does not want to rescue the bad decisions made there. In fact, they see the losses and pain as healthy for the economy longer term. And, the stock market will see that, too.

We say all of this to reach these logical conclusions:

- The Fed has slowed the economy. Unemployment is going to rise.

- That will give the Fed the room it needs to revert to stimulating the economy by lowering interest rates.

- We think they will begin soon and continue doing so at a measured pace for several months.

- The stock market loves it when the Fed lowers rates -- it means the Fed does not fear inflation and is trying to stimulate economic growth.

- That will lead to an attitude that earnings growth will be stronger and more sustainable.

- As the market looks ahead to 2008, stock prices should start to rise and that could continue as long as the Fed continues lowering rates.

- We are bullish on prospects for stocks over the next 18 months.

Tuesday, September 04, 2007

The Fed Rate Cut: How Much?

As we returned from the Labor Day weekend, there are still some in the financial media that are saying that the current state of the economy does not warrant a cut in the Fed Funds Rate.

As we returned from the Labor Day weekend, there are still some in the financial media that are saying that the current state of the economy does not warrant a cut in the Fed Funds Rate.We don't agree and history shows that the Fed has cut rates in the past, even when the economy was not in or near recession.

The chart at the right shows the yields on 90-day T-Bills (blue line), which are backed by the full faith and credit of the US Government; the Fed Funds Target Rate(green line), the rate paid and guaranteed by banks; and the difference between the two at the bottom (red line).

The top part of the chart shows that for most of time over the last 20 years the interest rates on 90-day T-Bills and fed funds have stayed very close together. This would make sense. One strong bank borrowing from another would not expect to pay a rate of interest much higher than the government would have to pay for a short-term loan.

However, when fears of recession or the strength of the banking system is called into question, the spread between fed funds and T-Bills widens. Why, because big investors decide they feel safer in government backed T-Bills than they do in the banks and they bid T-Bill yields lower.

To see this, let's focus on the red line at the bottom of the chart, which shows the difference between the Fed's Funds Target Rate and the yield on a 90-day T-Bill.

Each time the yield differential has been at least one percent, the Fed has cut rates within a short time. In addition, you will note that T-bills have always led fed funds lower.

There have only been 5 times in the last 20 years when the yield differential between T-bills and fed funds have been approximately one percent: immediately after the stock market crash of 1987, during the Saving and Loan Crisis in 1989, during the Asian Flu of 1998, in mid 2000, when it was clear that the Tech bubble was popping, and today.

The chart is a month-end chart so it does not show every day for the last 20 years, but it is remarkable that on a month-end basis that the events of September 2001, did not produce a one percent spread.

These one percent spikes have occurred coincident with an extreme crisis of confidence in the financial markets, not necessarily in the economy. The US economy was fine in 1987, 1998, and 2000 at the times of the spikes.

Thus, the arguments today that the Fed won't cut the fed funds rate because the US economy is not close to recession is beside the point. The point is the Fed has a financial crisis to deal with and history shows that the way they deal with these types of events is to cut rates. They can always raise rates later if the crisis passes without a sharp fall off in the economy.

The arrow at the far right of the chart shows that the recent spike is higher than at any time going back to 1989. In our minds, the question is not if the Fed will cut rates, but how much? One of us thinks .25%, the other .50%.

Friday, August 31, 2007

The Fair Value of the Dow Jones Industrials --Too Cheap

By our reckoning the stock market, as measured by the Dow Jones Industrials, is significantly undervalued, maybe as much as much as 13-15%. We make this call based on the readings of our Dividend Valuation Model using the most recent data available.

The chart at the right shows the model going back to 1975. The blue line is the average annual price of the Dow and the green bars are the model's predicted values. The model uses only the dividends paid by the 30 companies in the Dow and long-term high-quality bonds.

The chart at the right shows the model going back to 1975. The blue line is the average annual price of the Dow and the green bars are the model's predicted values. The model uses only the dividends paid by the 30 companies in the Dow and long-term high-quality bonds. Sunday, August 26, 2007

Dividends Do it Again

- Top 100 highest yielding stocks -1.4%

- Next 100 highest yielding stocks -2.8%

- Next 100 highest yielding stocks -3.6%

- Next 100 highest yielding stocks -3.6%

- Lowest 100 yielding stocks . . . . . -7.1%

The inverse relationship is very tight with stocks with the lowest dividend yields performing the worst and stocks with the highest dividend yields faring the best.

One might conclude that this is the way it ought to be because higher yielding stocks are more mature and usually more creditworthy, but that would miss the point that many REITs and Banks are included in the highest yielding quintiles, and these sectors, initially, took a solid thumping before recovering.

My conclusion is going to sound familiar: dividend paying stocks are easier to value because a good portion of their rate of return is produced by their dividend, thus, in a manner of speaking they are more transparent.

Speaking of transparent, that will be the key word to describe the recent subprime mess. Too many companies were more deeply involved in the subprime market of one variety or another than they disclosed in their quarterly and annual reports. When management is playing fast and loose with their shareholders' capital and not disclosing it, it is a breech of trust and they deserve to be fired without benefit of the usual golden severance package. I'll have more to say on this in the coming weeks.

Friday, August 24, 2007

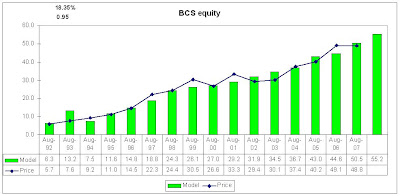

Barclays is Cheap

stocks were too cheap.

stocks were too cheap.The chart at the right shows that both stocks have recovered smartly over the last two weeks, as it has become clear that, indeed, neither is likely to take big losses. As we write this, however, we believe both stocks may be still as much as 15% undervalued based on the long-term relationships between their dividend growth, interest rates, and their stock prices.

We want to add another stock to the list of banks that we believe has been unfairly punished by the recent liquidity crisis. Barclays Bank is a London-based bank with offices spanning the globe. They have three world-class divisions: banking, capital markets, and asset management (ishares Exchange Traded Funds).

The stock has fallen by nearly 20% over the last 60 days on fears of Barclay's involvement with sub-prime loans, private equity, and hedge funds. There is no way for us to know their precise exposure to these groups, but the company has repeatedly stated that they are not experiencing any large scale losses.

Barclays recently raised their dividend by nearly 18%. A dividend hike of that magnitude is real money since they now yield over 5%.

The chart at the right is Barclay's Dividend Valuation Model. The blue line is the actual annual price over the last 15 years, and the green bars are the model's predicted values. The chart shows a close association between the model and prices over the last 15 years and a predicted 2008 value of just over $55.

From today's price of approximately $49, including the dividend, our model is suggesting that Barclay's may be even more undervalued than BAC or WFC.

Barclays has been in business since 1736. With that kind of longevity, we believe they might know a thing or two about how to navigate financial storms. Their AA bond ratings ensures access to the capital markets and minimizes liquidity issues.

The bank has been in a pitched battle with the Royal Bank of Scotland to acquire ABN Amro, a Dutch banking giant. We believe that the market is worried that Barclays may be dragged into a bidding war. In our minds, Barclays had done a lot of things right over the past 270 years. We're inclined to follow with their judgment with ABN Amro.

Tuesday, August 21, 2007

Energy: The New Y2K -- Boeing, Toyota, and United Technologies

While we are grappling to understand the height, width, and breadth of the mortgage crisis, another crisis that we have detailing has fallen off the front pages: the energy crisis. Here's why we have been describing energy as the next Y2K:

- 9-11 was a harsh lesson in the Islamists' visceral hatred of our Western way of life, and the fiendish extremes to which they would go to harm us.

- The internecine fighting in Iraq, if anything, should be a constant reminder that the terrorists seek to destroy anyone who stands in their way, even their own people.

- Katrina showed how fragile our refining and energy distribution systems were.

- Too much of the American, yes the Western, way of life is held hostage to energy; and too much of the world's energy supply is in countries who hate not just Americans, but any country that follows an open society of free markets and democracy.

The recent sell off has hit almost all stocks and sectors. During this sell off, we have been nibbling on the three stocks that we believe currently possess the best technology and products to dramatically reduce energy consumption, without abandoning out our way of life-- Boeing, Toyota, and United Technologies. These three companies currently have products on the market that can reduce energy consumption by up to 50%(compared to older technologies) in planes, automobiles, and heating and air conditioning systems, respectively.

Here's our bottom line, and we are borrowing from a press release by the World Business Counsel for Sustainable Development (WBCSD): There is a talk about "green" this and "green" that, but, thus far, most individuals, companies, and governments have done very little to diminish energy consumption.

Energy conservation may seem like an oxymoron, but we believe that a true cost-benefit inflection point is near, when people will realize that the technology is available and affordable here and now to dramatically reduce energy consumption.

The reason we call this an Energy Y2k is because when that day comes, there will be a mad rush to get aboard the new technology. We don't know what will cause it, and we have no special skills at seeing the future, but no individual, corporation, or government can live beyond its means indefinitely.

In saying this, we are not talking about doomsday or end-times. We are just saying that there are technologies available that offer people some insurance against rising energy prices, resulting from uncertain energy supplies, and the wisest course of action may be to own both the new technologies and the companies who own them.